After revisiting Szabo’s The God Protocols for an upcoming project with my friend Nathan (who nicknames Bitcoin the God Coin), I couldn’t help but take a trip down memory lane.

I grew up in pretty modest means early in life, which might be why money’s always fascinated me. Especially the mechanisms through which different governments at different times in their history communicated money. For the past few centuries, up until what turns out to be the imminent end of the base analog era of money – that’s been by way of physical coins and notes.

When I was very young, I collected coins. Collecting is an understatement – more like obsessed over them. Their form factor was a source of endless fascination. Organizing them. Cleaning them. Precious… maybe a bit of Gollum energy.

It’s unclear why, but I’d pour over those coins. I’d be electrified when coming across new coins. Finding wheat pennies felt like winning the lottery. I had questions for every coin: how did they decide your circumference and material? Bi-centennial variants omg. Liberty half dollars… SILVER DOLLARS?!

Some family members were hobbyist numismatists, and I caught that bug early on. They encouraged me and helped me develop an appreciation for the space. The first time I laid eyes on a Canadian nickel I nearly flipped — not a smooth circle!! I’ll never forget finding a rusty old mercury dime, nearly a century out of print, resting in the dirt near my Grandma’s house.

Later I started collecting paper-based financial instruments. Family members visiting other places would bring me foreign notes from their travels afar. I was 8 years old when I first obtained Confederate Notes from each civil war era southern state – long before I understood the atrocities of that war, or why it was fought, or that the notes were counterfeit 😀

I was fascinated by the differences in how notes were marked with serial numbers, the special designations, the mint’s insignia, the intricate artwork of the people and the buildings and the pastoral scenes depicted on both, and especially the badges, the rosettes and the guilloche. And, in later designs, the security mechanisms: I might’ve pulled the little plastic strip out of a few bills to see how they work.

Silver certificates were an enigmatic and strikingly beautiful expression in my collection – with their blue badges, and the subtle differences in wording about in whom we trust, and how the note is valued. But I was too young at the time to grasp what their existence meant – that at one time our money had been backed by something real and tangible, whereas by the time I was collecting money instruments, the notes were only legal tender.

I would count coins and recount, and try to devise new ways of counting the coins using volumetric means like stack height. I would build from cardboard, glue, craft sticks and newspaper wrappers elaborate villages with banks and hidden vaults to store the coins.

My grandpas would give me interesting coins for my birthday. Family would take me to coin & precious metal shops, where I’d nearly melt from excitement. I once received a guide showing the worth of various coins out of circulation, and would spend hours figuring out the relative worths of my collection, and which coins I absolutely had to have someday.

The passion extended to precious metals. While I didn’t have much money growing up I did receive small amounts of silver and gold as gifts I cherished. I would track the commodities prices daily in the local newspaper.

You could say I didn’t get out much when I was young lol. But later in life I would keep this fascination with coins and currencies and the general ideas of money. I’d start a company that tried to make a digital version of bearer bonds, not dissimilar to what Szabo had described. I’ve since collected hundreds of legacy financial instruments from around the world.

Base Digital Money

I first heard about bitcoin in convos while visiting MIT 2009, but didn’t pay much attention then, since there wasn’t a form factor to digital money. I put off reading Satoshi’s paper until 2010. At the time I was struggling financially and with depression, trying to build a company while trying to pay off student loans – it was a very bitter time, and it didn’t help having recently watched the bank bailouts.

Satoshi’s paper was a major “aha” moment for me. It beautifully solved so many problems in not many pages. I was struck by the eight decimal precision. Though not “Sats” at that time, the unit it represented seemed significant. I wanted to think Satoshi intended some use for that number of decimals. At any rate, the decision to make a “coin” – almost every base analog currency worldwide stopped at two decimals – to make a coin that has 8 decimals of precision surely meant something. It meant there would be 2 quadrillion of what we now call Satoshis – which happens to be the same order of magnitude of all money it all its forms worldwide.

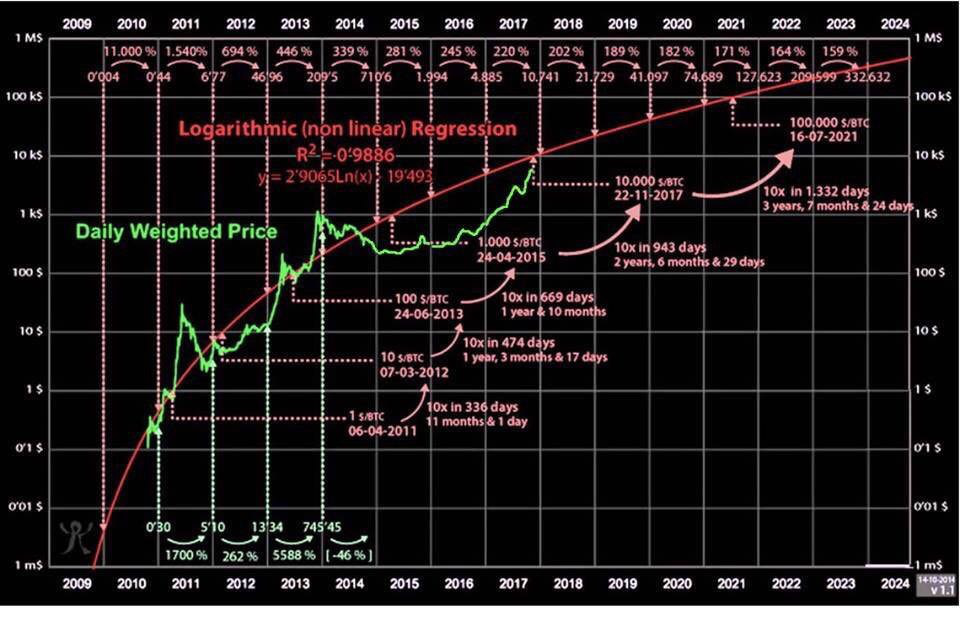

Perhaps the day would come when the unit now known as Satoshi would be worth a penny ($1 million / bitcoin). Or perhaps a dollar ($100,000,000 a bitcoin!). It seemed plausible, however outlandish at that time. But the current all time high reached 6.4% the way to my initial lower bound projection.

The biggest financial mistake I’ve made so far in life is putting that paper down in 2010, thoroughly convinced that bitcoin is going to become a viable digital currency, and doing absolutely nothing about it for a year. But the smartest financial decision I’ve yet made was to start investing mid 2011. I didn’t have much to invest, but I did manage to keep a small portion of that bitcoin for a decade. I’m surprised that 10 years have gone by – that was fast! — but not at all surprised by the current price of bitcoin. It seems to fit with Satoshi’s decimal precision design.

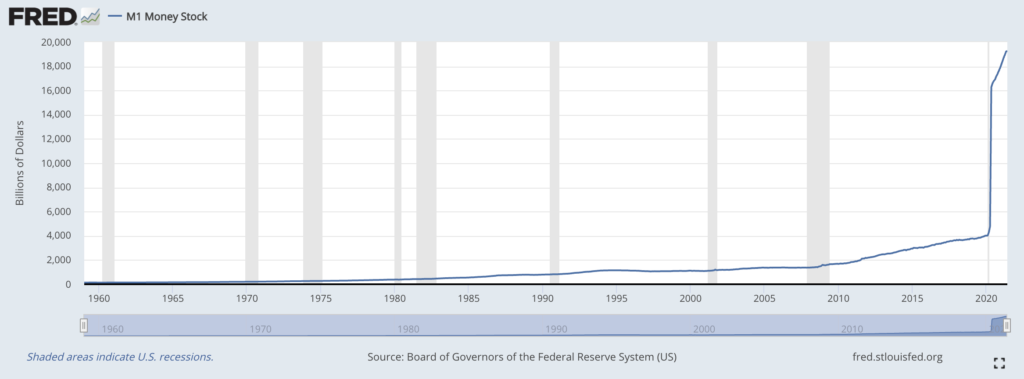

Having sold most bitcoins I had from those days, and having paid what felt like a lifetime’s worth of taxes in a few years as punishment for doing so, I will never again sell another bitcoin. Not because I want to hoard them, but because now I think bitcoin could be a great fiat debasement hedge. Back then I, like most Americans, thought the US Dollar was the permanent global reserve currency. But 2020 showed us that even the world’s reserve currency can be debased. Mnuchin directed the single greatest expansion of money supply in the history of humankind. Yes printer going “BRRRR” sought to avoid the COVID Recession becoming the COVID Depression. Or was it the other way around? Given that Event 201 happened exactly 1 year prior to the start of the real COVID outbreak, it remains unclear to me which was cause and which was intended effect.

No matter which is which, it doesn’t take a Zimbabwean historian to figure out what happens next.

This is why I’m so thankful that bitcoin is mathematically trustworthy in its finite supply. In addition to operating continuously for over a decade without a single breach, zero double-spend, or any other failure mode problem it could’ve faced along the way, bitcoin hasn’t exceeded its maximum allowable supply, as it simply cannot. There will only ever be 21,000,000 bitcoins, minus the ones on all those hard drives in the landfill, or in wallets with unrecoverable passwords.

(Side note: sometimes I wonder if Elon loves DOGE because as a LTC fork it has many characteristics of bitcoin but without the supply constraint – does he want humankind to have a digital fiat currency rather than a fixed supply?).

By virtue of its trustless design and decentralized architecture, no government can “ban” bitcoin. Every member of the UN could team up to “ban btc” as a group, and it would still be just as fruitless, as long as enough people agree to trust its mathematical trustworthiness, and enough infrastructure exists to facilitate its use in everyday situations.

This is why, to me, bitcoin is more powerful than any gun in humanity’s defense against tyranny. “Give me control of a nation’s money supply and I care not who makes its rules.” – Mayer Amschel Rothschild.

If Rothschild’s startling thought could be remixed for the emerging base digital era, what would it say?: Perhaps something along the lines of: “Give us a money supply that needs no nation, and we care not which ruler tries to control us.”

At this point it seems beyond the skill of central banks stop the inescapable end game: btc becomes humankind’s reserve currency. But I believe they’re smart enough to see that it’s inevitable, and that it’s something that’s sort of going to happen with no magic tipping point moment.

Over the coming decades, BTC and all the crypto projects built on its principles will simply continue to absorb increasing amounts of global liquid value. As more and more people believe in it, as more people and places use it, and more brilliant ambitious engineers build new features and infrastructure for it, monetary value will just continue to transfer from base analog to base digital.

That’s exactly what’s been happening the past decade, right under our noses.

From its initial “big bang,” when bitcoins were worth $0.0000001 / btc (and, infinitesimally small moments before that), to that time 10,000 bitcoins bought two pizzas, to its 2017 intercept of $10^5 / btc ~within one week~ of Tuur DeMeester’s log regression projection (which he made 3 years prior!), to our current run up to $10^6 / btc possibly sometime this year? – there are two thoughts I value even more than the excitement of seeing something so elegant grow up:

1. Bitcoin price isn’t rising. USD is just worth less, so it buys less BTC.

2. Bitcoin and all crypto networks founded on its principles are together enabling the base digital future of money, and these networks are just absorbing the value from the final days of base analog money, like a digital towel.

In this way, BTC will essentially become the de facto global reserve currency, not by mandate of any one government or bank– they cannot decree its legitimacy any more they they can stop it from happening (though El Salvador forcing its acceptance as tender is an important milestone and proof point).

All of this to say I think BTC could hold its own as a fiat currency debasement hedge, and with all of the great projects being built by brilliant minds all over the world, it will make a great reserve currency for humankind.

In God Coin We Trust.